I was recently having a group lunch with a group of ex-pats chatting about life in Turkey. The well-worn topics of Rental Increases and House Prices came up as usual. Many theories and economic concepts were put forward and discussed. Many ex-pats are feeling that the cost-of-living is a recurring issue that they are not used to having to deal with. Rent increases and the rising cost of residency permits as well as the new admin and costs of renting out a property are adding to the cost-of-living concerns.

As a result, regular themes for ex-pat discussion and social media posts is “Should or I stay or should I go?” and “What should I be doing?”

I was asked what I thought was happening in the housing market. Why was I asked? I’ve lived in Turkey for nearly 24 years and have had a hotel and property business here for the last 22 years. In that time, I built a boutique hotel and, together with my wife Sue, ran it very successfully for 17 years and I’ve bought a few properties. Therefore, I’m regarded as someone who may have some business acumen and a good first-hand view of the markets.

So rather than just spouting out my ideas I decided to do some research. Herein are the results, I hope you find them interesting and or useful.

Massive increases

Throughout this year social media has been littered with posts about property issues and rent increases in particular. Some of the posts indicate apparently outrageous rental increases. The government did temporarily step in to limit rent increases to 25%, but when this was lifted there was a further outbreak of irate renters.

Inflation increases

Some of the rent increases were more reflective of inflation which has ranged from 40% to 80% over time, depending on how you measure it. The commercial rate for rent increases, based on government figures was approximately 58% during the summer. This is based on an average of the official inflation rates TEFE & TÜFE which are the equivalent of UK’s CPI – Consumer Price Index and WPI – Wholesale Price Index.

Whys and Wherefores

Property owners were often described as greedy and intransigent. Renters felt pushed over a barrel and were amazed when their threat to leave was greeted with little interest and no offers of a discount. This despite them having been good occupants and regular payers.

So, what is going on? There are a number of economic elements that combine to inflame this impasse.

The property owner wants to make a return on his investment and this should be a better return than he can get at the bank (currently 48+%). He also wants to be sure he is getting the full market price. He will be hearing stories from friends, family and business contacts. This view may be an inflated rental figure. If he can’t achieve a good return then he will consider selling. Bear in mind also that the value of his property has increased very significantly in the last two years. Thus, he wants his return to be based on the higher value of the property. They will also feel that due to the previously state imposed limit of 25% the current rental is less than if an inflation tracked (60% ?) increase has been applied. This shortfall will never be recovered even if inflation tracked increases are added in the future. Therefore, selling might be quite an attractive option.

The objectives for the property owner are: –

If the property owner cannot achieve the return from the current occupants a vacant property gives them a chance to see what is the maximum achievable rental is. If he can’t improve on the return he gets from the current people, then the property is ready for sale and the proceeds can be invested elsewhere.

The Turkish economy is very dynamic and you have to be flexible and fleet of foot to take advantage of the opportunities that are available at any given time. Turks are generally much more well versed in such matters than most ex-pats. For many property owners, rentals are a second income which they want to manage in the long term. Most are not desperate for that income month by month.

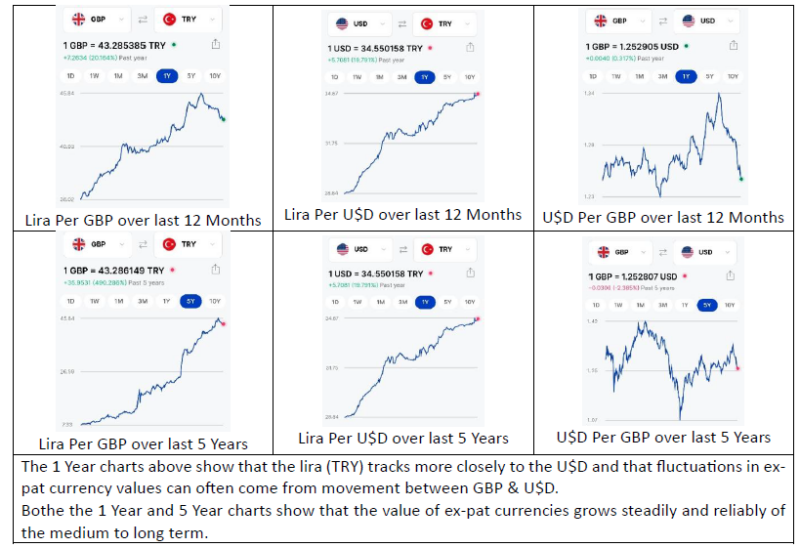

For the ex-pat renters, exchange rates have had a major effect on their spending power. For most ex-pats coming from strong economies, inflation is not something they have had to deal with since they were quite a bit younger. In UK, the cost-of-living “crisis” was caused by inflation reaching 8%. In Turkey inflation has been 10 times that. In the past Turkish inflation has been counteracted for ex-pats by a rise in the exchange rate for their home currency. Sterling (GBP £) has not kept pace with inflation. The GBP:TL rate in 2022 was 21.53. If the pound had followed inflation at an average of 60% for 2 years, then the rate today would have been 55.27tl. I think most would agree that a rate of 55tl would ease, if not remove, many current issues.

If we assume the generally accepted inflation-based rent increase of around 58% is normal. The change in the vale of GBP in the last 12 months has been from 34.22tl to 44.65tl which is 30%, 28% behind the assumed inflation rate. This not only affects rents but everything you spend on. This means that those on lower and or fixed incomes and anybody on low and or fixed incomes in Turkish Lira will be feel the most pain.

Legal Issues

I have reviewed many of the posts on social media and particularly those on the Facebook page of Turkish Legal Consultancy /website www.turkishlegalconsultancy.com.

It immediately becomes clear that in order to do “a good deal” when a property is first rented a number of legally dodgy steps are often taken by both the property owner and the renters. Common instances are cash payments in foreign currencies, often for extended rental periods (e.g. multiple years). No formal contract, contracts showing reduced rents and unusual additions to terms and conditions.

This means that when a property owner asks for a rent increase that the renters find unacceptable the renters are very often in a weak legal position. For example, no contract and no legally acceptable record of payments.

This leaves the renters in a very weak position to claim their legal rights, which are actually quite strong in Turkish law. An apparently simple rental contract is actually backed by hundreds of pages of applicable law that deals with what is allowed or not allowed and responsibilities for virtually every aspect of a property rental.

Dodgy arrangements generally favour the property owner in times of conflict or if they want renters out of the property.

What of the future?

House prices have boomed in the last few years and consequently rents have typically increased by similar amounts. There are signs that house prices may have reached a plateau when measured in foreign currencies. Interest rates have been high, as they track inflation, but are generally expected to fall gradually into and through 2025. This is generally expected to result in a decrease in the value of Turkish Lira against foreign currencies. That being the case you can expect the amount of Lira you can get for you GBP / € / U$D to increase over time, as has been more usual in the past.

The likely outcome will be that rents will continue to rise in line with a reducing level of inflation (in Turkish Lira), but those increases will be partly offset by the rise in the value of your home currency.

Will rents in your home currency eventually drop back to 2022 / 23 levels? Unfortunately, this seems to be highly unlikely.

The Fethiye Bubble

Probably the first thing to say is that Fethiye like Marmaris, Bodrum, Antalya and other major coastal tourist towns are not typical of most areas in Turkey. We are surrounded by beautiful mountains that look down on sun drenched beaches on the edge of turquoise seas. The weather is great with generally short periods of wintery weather (particularly compared to Northern Europe, North America and Canada). The rich cultural heritage and depth of history mean these places have been desirable destinations for thousands of years. According to Alice Roberts in her BBC programme, ‘Ottoman Empire by Train,’ close to 40 million tourists come to the country as a whole each year.

This means that property is highly desirable in these areas and as a result land prices are extremely high. The mass development of areas like Fethiye has led to a shortage of building land pushing land prices higher and higher.

Desirable destinations mean opportunities for business and not just tourism and construction. Supplies of all sorts, logistics, professional services, shops, restaurants (not just tourist ones) as well as tourism have all created a growth in population and demand for accommodation and workspaces.

Fethiye is and continues to be a thriving environment and is, to quite an extent, different to Turkey as a whole. This means that Fethiye is in a bit of a bubble but perhaps not too different to many towns that have grown due to rural people leaving the fields and moving to the cities. Whilst it is a bubble, it in no way compares to the economic powerhouses of Istanbul, Ankara and Izmir, who between them account for 28% of the population but, significantly, account for a much higher percentage of wealth. The middle class in Turkey has grown massively over the past 25 years as people have moved off the land and into the cities. The economy has moved a long way up the value-chain. 25 years ago, the automotive components sector was making brake pads and exhaust pipes. The automotive sector now assembles complete vehicles and can offer low-cost engineering to the highest of standards. Many other sectors have moved in the same way. In an emerging / developing economy there will be a vast difference between the top earners and the lowest paid. Turkey’s economy is now the 17th largest in the world is home to many of the world’s richest people.

There is now a significant growth in the number of cash rich Turkish property buyers from the bigger powerhouse cities.

Properties in Fethiye are very significantly cheaper than the same property in Istanbul and offer a good tourist rental opportunity. This makes them a good investment opportunity as a holiday home, holiday rental. In the longer term the property could also be a retirement destination that would represent a welcome financial downsizing from an Istanbul home.

There are also a growing number of Iranian, Syrian and other Middle Eastern buyers.

In the last 18 months house prices and rentals have been skewed by the influx of Russian and Ukrainian expats. Whilst some have settled a good number have also moved on to other countries to find lower prices and the to avoid some of the rigours of Turkish property administration.

AGBI Report summary

As part of my trawl across the internet I came across a report from The Arabian Gulf Business Insight website. For the full report click here.

The report is a national report and is a good indication to general market conditions. I will highlight some specific local variations as appropriate.

The key points of the report are as follows: –

Headlines

Market Bounces Back to 2022 Levels

Prices are normalising after unsustainable highs driven by the war in Ukraine and high inflation rates.

Over 140,000 residential properties were sold in September, 37% up from last year. Best figures since 2022. This is the 3rd monthly improvement from 79,000 units in June.

Year-to-date sales up to and including September were 947,000 up 5% on the same period last year.

New build sales were up by 47% with pre-owned rising by 33%.

The Central Bank’s Residential Property Price Index (RPI) was up 1% in September the lowest rate of increase since July 2021. However, if you take into account the CPI inflation the RPI fell by 15% in ‘real’ terms.

According to Real Estate Economist Ahmet Büyükduman, rental prices have become very high, so the ratio between purchasing and renting has come to an attractive level for investing.

Mortgage sales were 16,000 in September almost double September 2023 however overall mortgage sales are still down 47% year-on-year. This is due to high interest rates (4% per month or more) and also to state imposed limits on the level of credit that is allowed.

Market Drivers in Fethiye

The AGBI report is national and Fethiye has some notable local variations. The report highlights that a lot of activity is at the lower price range (below $100,000) which is below much of the market for this area.

However, most of the general drivers still seem to be holding true for Fethiye. Prices do seem to have normalised. Some sellers are making price reductions more than once to get a sale. This is often due to sales prices initially being set to follow prices increases that haven’t arrived and the fall in prices that has actually come about. Generally, small discounts are more available.

New purchases by Western European ex-pats are slowing. There are numerous reasons for this but any combination of inflation, the war in Ukraine, Middle East tensions, fear of instability (political & economic) and cost of living worries both in Turkey and at home.

The influx of Turkish and Middle Eastern buyers is present in Fethiye although possibly less so than in places like Istanbul and Ankara.

New build sales are slowing but builders seem to be holding out for their initial prices as they seek to recover their inflated build costs. These will become more affordable as and when the economy grows both here and abroad.

If you follow social media, particularly the ex-pat sites, you might expect to have been trampled by the exodus of people ‘going back’ or moving on. A number of people have decided that Fethiye is no longer for them, but it has certainly not been a mass migration.

Those that have left or are making arrangements to do so fall into a few groups: –

Renters

There are more Renters leaving than Owners. Everybody’s situation is different but some common themes have come to the fore.

There seems to be a pocket of Full-Time renters that believe that other countries (Spain, Portugal, Bulgaria & others) offer a lower cost of living. Of all those that have considered such a move it is the minority that have actually gone. The drivers for these decisions seem to be the level and flexibility of current income and the investment needed to make the move. There have been some horror stories amongst those that have moved. Typically, very difficult admin for residency and some significant fees to pay for admin consultancy.

There are a number of Part-Time renters that have decided to de-camp back home. Some may be considering looking for another destination to go and rent somewhere. Others are making or considering a move because the cost of living and increased rentals are detracting from the enjoyment and or value of their time spent in Fethiye. Some are considering giving up their rental property, which is often rented year-round, and booking short term rentals or hotel accommodation in the future. Again, these number have not been high.

Owners

Some owners are putting properties on the market. Resident-Owners are more likely to be selling up for the usual cyclical reasons (see Market Cycles below). Some Holiday-Home-Owners are deciding that the increased administration and costs associated with low levels of rentals are not worth the hassle. BusinessOwners are largely staying put. Some are seeing that prices have peaked and levelled off. If they have had a few years of good rental returns then this might be a good time to divest.

There are a number of properties, particularly amongst Resident-Owners that are coming onto the market in order to downsize. There are some of these which are part of the usual Market Cycles. There are a few extra at the moment, where the idea of a more manageable property and some extra capital in the bank is an attractive proposition. Particularly where the cost of living is beginning to bite.

Market Cycles

The vast majority of ex-pats are in their golden years and as time passes every year seems to get a bit more ‘golden.’ There is a natural aging cycle that churns the property market through ill health, changing (more manageable) accommodation needs, deaths, new family needs back home and so on.

There also seems to be (in the experience of a number of estate agents) a 5-6 year cycle which is just a result of changes in peoples’ lives. These can be financial, health related (own or family back home), life objectives & aspirations or just wanting a change.

Turkey’s economy is very changeable and dynamic and economic forces vary and counter balance much more rapidly than is more sedate economies. This dynamism is very important to Turkish investors who will move rapidly on an investment opportunity. There is plenty of investment capital available in Turkey. When conditions are right there will be a sharp influx of Turkish investors.

The core areas of Fethiye are now fully developed, there is very little land available for development in these areas. Development has continued and is continuing in more peripheral areas. These less central areas offer good medium term investment opportunities as the property value generally grows well as infrastructure grows in the area and land prices start to increase. There are opportunities to buy new build, some preowned and off-plan properties in these more peripheral areas.

There are areas such as Koca Çaliş which are predominantly Turkish owned homes on housing sites. These properties are decades old and generally used as summer homes. Typically, these have been owned by a senior family member and used by the broader family and friends. Some have now been inherited or passed on. Some of these properties are not so much the dream homes of new owners or the broader family. Those that do come onto the market can be good value. Some are quite old and in need of a bit of TLC or modernisation, others are already modernised and expanded. Either way there are some nice places or investment opportunities coming onto the market.

Finally, from a short tour around Fethiye it becomes clear that many areas are moving up-market. In some areas this may be additional facilities and infrastructure, in others it’s more of a redevelopment. Not many establishments come under new ownership or management and move down market. Fethiye has moved from being a basic, low-cost holiday destination. Customers want better standards of food, hygiene, décor and service. Fethiye is a much more ‘boutique’ destination than it was. Rising costs, increased wages and costs for outlets mean it is almost impossible to make a cut-price business, particularly over a short tourist season. You can expect this gentrification to continue in the coming years.

Property prices have normalised but this is due to normal economic influences rather than a mass exodus of ex-pats. The right property can be found at the right price if you have a medium to long term view.

The supply side of the real estate market has not outstripped demand and by far the major portion comes from the usual market cycle.

Very few people (none?) who invested in property 5 years ago have lost money regardless of whether that is measured in hard currency or Lira. Most investments, if not all have grown in value. This will more than likely continue in the coming years as it has been the case in all the years (24) that I have lived here.

The rental sector will likely continue to be interesting to investors whilst the ratio between rental rates and property values remains high. The rate of increase in rents is likely to slow over the next two years. But will still increase year-by-year in line with inflation.

Owning properties that are to be funded by rental income is now much a more formal administrative process and hence cost. To make a good return then this must be run as a formal business and marketed well to get good occupancy rates. Such enterprises will be subject to normal business fees such as accountancy fees and will be subject to state taxation rules and legislation. Taxation controls will continue to increase as the economy matures. A similar change in the hotel sector some 15 years ago led to businesses responding to these challenges by moving up-market. This has also been seen in Fethiye where most of the original ‘basic but clean’ pansiyons have been upgraded or re-built.

Opportunities for rightsizing & buying as an investment are there for those willing to consider less than prime areas for their property. Rightsizing gives the opportunity to get a property that is more suited to your current needs and also to move to an area where you can get more for your money. Further afield there are off-plan opportunities as well. These are areas where there is currently a good level of investment by Turkish buyers.

Renters who find their new rental rates unaffordable may have to consider moving to a less prime location. There are still some more affordable properties to rent but they are increasingly hard to find.

Currency values for ex-pats have been weak through 2024 and the election of Mr. Trump in the states has caused them to fall dramatically in the last 2 weeks. This latest change does however have to be seen in light of a long and steady growth in ex-pat currencies (particularly GBP) throughout 2024. Whether this is a normalisation or whether we will see more erratic shifts as a result of the new president is yet to be seen. The latest change will not be good news for those on low and fixed incomes. Exchange rates can be volatile but hard currencies generally normalise and continue to grow against the lira over the longer term.

We currently have economic conditions that combine to make the cost-of-living an issue. This is hardest on those with low and fixed incomes. In the future the Turkish economy will continue to expand, move up the value chain and become more mature. This will lead to a gradual increase in the cost-of-living. The cost-ofliving in more developed countries is also growing. Turkey will slowly become a more expensive place to live but will still retain an advantage over ex-pat home countries.

Most traditional Home-in-the-Sun destinations have been affected by inflation and have increased the cost and administrative complexity for residency permits.

The real estate market in Fethiye is neither booming nor declining. Property sales prices seem to be normalised and sustainable.

Over the medium and long term, Turkey’s real estate market is a secure place to invest in property, despite intermittent fluctuations.

Fethiye is a very desirable area for both domestic and foreign buyers. Properties offered at a reasonable price will normally sell promptly. That is certainly the case at this time. Current market conditions are strong for buy to let investors. There are also opportunities for a multiple purchase to fund or subsidise a primary property. E.g. buy two or more villas or apartments, use one part time and rent it out when vacant & rent out the other(s) full time.

If you invest in a holiday home / retirement destination home, a good supplementary income can be achieved when the property is vacant. However, the level of occupancy needs to be high enough to cover the base costs of a rental business.

For the short term 18-24 months it is likely that renting will be less attractive than purchasing. This is generally the case. However, it is a good option to rent for a year or so before making the final commitment to a purchase. This would allow you to answer questions like “Is Fethiye/Turkey the place for you?” “Where is your ideal location to live in rather than to holiday?” “How can I finance a secure future in Turkey?”

Whether you choose to rent or buy in the longer term, it is essential that you have a thoroughly worked out life style financial plan. The plan should always enough of a buffer to ride periodic fluctuations in the Turkish economy.

Currency Rates

The Future Inflation and Interest Rates

These figures are taken from a presentation given by Hakan Aran, the General Manager of Türkiye İş Bankası at the International Tourism Congress in Antalya. A full review of this presentation can be found by clicking here.

Headline Numbers: –

Inflation to be around 42% by end of 2024

Inflation to drop to 22% in 2025

Interest Rates to drop to 25% in 2025

Housing loans to remain unattractive throughout 2025

In the longer-term Aran sees the government’s single figure inflation target by 2026 as an ‘ambitious goal’ but said that reaching 12% by 2026 would be an acceptable outcome.

A keynote was to emphasise that reducing inflation and interest rates is a gradual process.

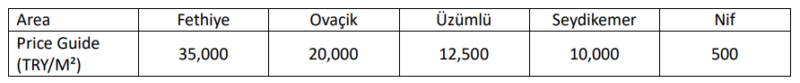

Prices by area

It is impossible to give property prices across a range of areas, there are just too many variables. So as a guide to the range of price variations by area, I have provided the following estimates of land prices. The prices given are in Turkish Lira square metre.

24 years ago, when I arrived in Turkey, automotive manufacturing comprised very low-cost production of simple items like brake pads and exhaust pipes. Ford have recently announced their 3rd joint venture factory in Turkey taking their production capacity in Turkey up to 415,000 vehicles, an increase of 110,000units. With specific reference to advances up the value-chain, they now employ 1,300 engineers working on the development of vehicles and engines. Engineers emerging from Universities like METU – Middle East Technical University in Ankara (https://www.metu.edu.tr/) are reaching global quality standards in many fields. This is in turn attracting a good deal of inbound investment and growing export opportunities.

A comprehensive guide to buying a property in Turkey is available from The Overseas Guides Company, a UK company based in London. They partner with companies such as Rightmove, Overseas Home and Smart Currency Exchange. It’s a bit sales & marketing focussed but does have some useful content. The sections on what kinds of property to consider, legal considerations and finance planning may well lead you to questions you may not have thought to ask. Generally, you can expect to find many answers to questions you may not have known you needed to ask.

You can download the guide at https://www.propertyguides.com/turkey/

I decided to write this because property, be it rented or purchased, is a large part of everyone’s cost-of-living. The Turkish Real Estate and Rental market is dynamic, can be confusing and can have pitfalls. The value of a trustworthy and professional agent, with a wide network of partners, cannot be understated. For that reason, I am posting this document on the website of the guy I would turn to, without fail in Fethiye, Selahattin Kaymak at Property Wizard Turkey.